Back

Markets

Feb 15, 2024

Market Analysis - Insights and Predictions for the Crypto Market

Bitcoin Macro

Market Outlook and ETF Dynamics

On January 10th, we wrote an insightful analysis that accurately predicted developments surrounding the ETF approval and its immediate aftermath. We've maintained a bullish outlook for months, forecasting the ETF's approval well before it was widely considered possible. Now, we'd like to discuss our perspectives on the current market and potential trajectories. Is the market nearing a peak, or is there significant room for growth?

Macroeconomic Landscape and Market Sentiment

Let's begin with the macroeconomic landscape. While we anticipated a lower inflation reading this month, perhaps around 2.9%, the actual figure was 3.1%. However, we believe recent inflation reports don't fully reflect the true state of inflation, which is likely lower than the CPI suggests. Despite lingering bullish sentiment, which raises some concerns about an overcrowded trade, there's still potential for an upward move as sentiment and positioning aren't excessively bullish yet.

Assessing Market Dynamics and Risks

We expect further gains unless market dynamics undergo a drastic shift. Yesterday's corrections in both stocks and crypto appear healthy, paving the way for additional upside. If the USD and bond yields have indeed peaked (a likely scenario), the rally in risk assets could gather momentum. However, this doesn't preclude the possibility of higher rates, a stronger dollar, and simultaneous gains in US equities and crypto. We're at a crossroads and will soon discover whether liquidity will contract or accelerate further.

Crypto and Stock Market Synergy

As stocks reach new all-time highs and crypto remains undervalued relative to stocks, a Bitcoin ETF provides a conduit for capital to shift from traditional markets into crypto. Bitcoin could reach $80k simply by aligning with broader stock market gains, irrespective of specific stock performance. While we don't see immediate signs of a market top across crypto or traditional stocks, another significant correction could be on the horizon. However, the potential for further explosive upside remains notable. Currently, Bitcoin is experiencing daily inflows of $500M USD, a trend that might accelerate. Given the powerful synergy between crypto and AI, we see crypto, alongside tech stocks and semiconductors, as a key indicator of bullish sentiment towards AI. This, combined with a Bitcoin ETF, creates a strong link and correlation between stocks and crypto.

Bitcoin Market Analysis and Predictions

We anticipated a price range of $52-53k for Bitcoin, following a brief pause around $49k and a retest of $39k. Overall, the market structure for Bitcoin and Ethereum remains bullish, even as Bitcoin approaches key resistance at $53k and shows signs of being overbought. We believe it's possible to reach $56k before a pause and a potential correction of 20-30%. While it's unclear whether this represents a local top, taking some profits seems prudent. A bullish sentiment underpins our view, but it's balanced with caution. There's a strong possibility of a market peak later in Q1, especially considering economic data and potential delayed effects from past rate hikes.

Historical Comparisons and Bullish Scenarios for Bitcoin

Here's a line of reasoning we've presented before: based on its chart, Bitcoin currently resembles the S&P 500 in 2010-2011. Why? Firstly, the charts exhibit striking similarities. Additionally, 2022 marked a '2008 moment' for crypto. The key difference? No bailouts. This led to exacerbated downside, potentially implying stronger future upside. Two further bullish cases exist. One suggests stocks are mirroring the early 1940s-50s or 1980s-90s, with technology driving significant booms. COVID-19 pandemic responses mirrored those of WW2, with comparable debt levels. AI has an impact akin to increased labor supply (similar to the baby boom and women entering the workforce). Moreover, the 2020 crash echoes the 1987 crash, and AI parallels the rise of the internet.

Bitcoin's Potential for Exponential Growth

We can also draw comparisons to gold in 2005. The launch of Bitcoin ETFs could spark a surge similar to gold's ETF-driven momentum. In approximately two months, Bitcoin's inflation rate will halve, matching gold's. Ethereum's inflation rate will drop even lower. With all these factors combined, Bitcoin has the potential for a 10-20x increase from current levels.

Bitcoin's Growing Dominance and Market Dynamics

Bitcoin's dominance is growing, with ETF flows favoring BTC over other crypto assets. This could lead to BTC outperforming the majority of coins until it significantly surpasses its all-time high. Typically, major altcoin seasons commence after BTC reaches its ATH or rallies at least 50% above it. Given this dynamic, our focus remains primarily on Bitcoin. While many altcoins have performed well, a large number haven't. Until the market gathers more bullish momentum and Bitcoin breaks new ATHs, attention will likely remain centered on it.

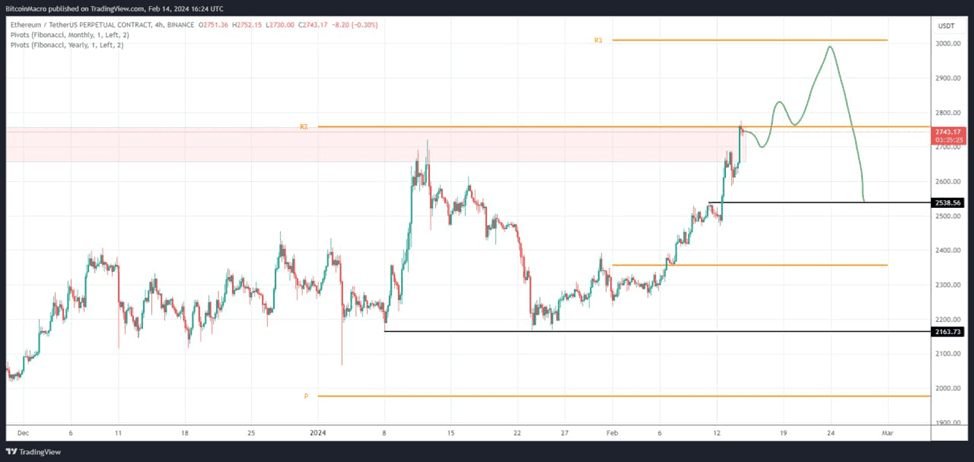

Ethereum's Outlook and the Impact of Regulatory Wins

Since the Ordinals revolution, Bitcoin is gaining more traction and market share, while Ethereum is losing market share to competitors and its own L2s. However, Ethereum could also go up a lot, as we believe that an ETH ETF will be approved in 2024. Due to the Grayscale and Ripple wins against the SEC, along with a potential win by Coinbase vs the SEC, and potential small wins from Kraken and Binance vs the SEC, the SEC will be even more cornered than before, and the existence of the ETH CME futures and futures ETFs, and the approval of the BTC ETFs, it’s nearly impossible that the SEC won’t approve the Ethereum ETF. Ethereum also has a lot more things going for it than Bitcoin, and could be more susceptible to a supply shock that’s larger than that of Bitcoin. However, in the short term, as flows really benefit Bitcoin, until ETHBTC gets to 0.04-0.044, Ethereum and crypto assets broadly might underperform Bitcoin.

The Path Forward for Crypto Assets vs. Bitcoin

The only way we see crypto assets outperform Bitcoin is if ETF flows slow down, if exchanges strike more wins against the SEC, if bankrupt companies or governments like the US start dumping their BTC (MtGox, Genesis, Celsius) and if it looks like an ETH ETF approval is more likely than thought before. Make no mistake: we are very bullish on crypto. We do think everything will rally a lot. Although Genesis, FTX and others are currently selling, and more selling will come from all distributions of crypto, as companies impacted by bankruptcies start repaying funds, we expect that a significant share of that capital will re-enter the crypto ecosystem, further accelerating prices to the upside. Just the fact that many of these creditors are going to get a lot more money back than initially expected, is a massive psychological boost that is also feeding into this positive feedback loop.

Conclusion: A Bullish Yet Cautious Outlook

Overall, we remain bullish on the market in the near term, but we're proceeding with caution. While immediate signs of a market top aren't visible, a sizable correction could materialize. Despite this, the potential for explosive upside is significant. Bitcoin's growing dominance, driven by ETF flows, suggests it will likely outperform most other crypto assets until it breaks significantly above its all-time high. The combination of macroeconomic factors, Bitcoin's potential to mirror past market surges, and upcoming catalysts like Ethereum's halving and a potential ETH ETF approval in 2024 create a strong foundation for continued growth in the crypto market.

Bitcoin Macro

Share this post